Opay offers quick loans to users in Nigeria, providing a simple way to access funds when you need them. If you’re looking to borrow money from Opay, the process is designed to be fast and user-friendly.

You don’t need lengthy paperwork or physical visits to a bank. With just a smartphone and an active Opay account, you can apply for a loan in minutes.

Opay provides loans through a feature called Okash, which is available within the Opay app. You can also use a USSD code to check for eligibility and apply.

Before applying for an OPay loan, it’s important to understand the requirements, interest rates, and repayment terms.

Below, you’ll find clear steps to borrow money from Opay, answers to common questions, and tips to avoid pitfalls.

How Do I Borrow Money from My Opay Account?

Follow these steps to request a loan through the Opay app:

Open the Opay app

Log in to your account. If you don’t have the app, download it from the Google Play Store or Apple App Store.

Complete and Verify your Account

Update your personal information, Link your Bank Verification Number (BVN), Add valid identification, Provide accurate contact details, Complete the KYC (Know Your Customer) requirements, Upload required documents, Wait for verification confirmation (usually takes 24-48 hours).

Check your eligibility

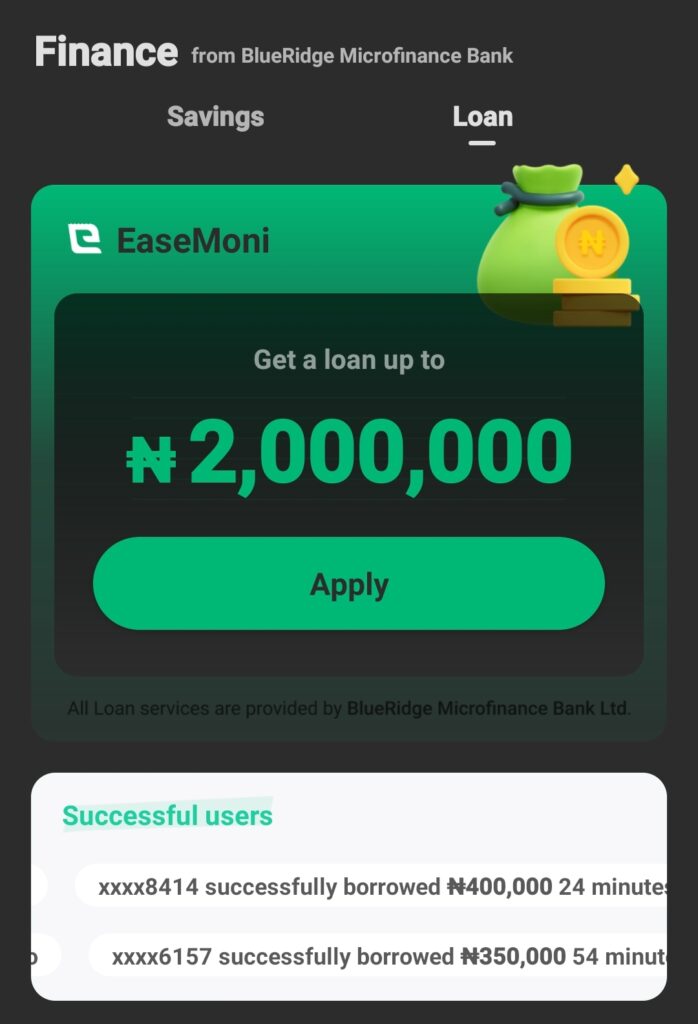

Go to the “finance” section and swipe to the “Loan” section and tap on “Apply”. Opay will display your approved loan limit based on your transaction history and account activity.

Select your loan amount

Tap on “Get limit” to give Opay permission to your camera, contact log and others. You may also need to make a video recording.

Choose how much you want to borrow within your limit. Higher amounts may require additional verification.

Review terms

Confirm the repayment period (usually 14–30 days) and interest rate (typically 1–10% monthly).

Submit your request

Tap “Borrow Now” and wait for approval. Funds usually arrive in your Opay wallet within minutes.

Requirements for OPay Loans

To qualify for an OPay loan, you must meet these requirements:

- Active OPay account with regular transactions

- Linked and verified BVN

- Valid government-issued ID (National ID, driver’s license, or international passport)

- Age 18 years or older

- Steady income source

- Good transaction history on OPay

What Is the Code to Borrow a Loan from Opay?

Opay uses USSD codes for some services, but borrowing money from Opay currently requires the mobile app. There’s no standalone USSD code to request a loan.

For new loans, stick to the app. Avoid third-party codes—they might be scams.

What Is the Name of Opay Loan App?

Opay offers loans through the EaseMoni services. While EaseMoni is available within the Opay app, it also exists as a separate loan application.

The loan terms, interest rates, and eligibility criteria are the same whether you apply through Opay or the standalone EaseMoni app.