If you need ₦50,000 urgently in Nigeria, several loan apps can provide quick access to funds. The challenge is identifying which platforms offer instant disbursement with minimal requirements.

The growing popularity of instant loan apps in Nigeria stems from their convenience and speed. Unlike conventional banks with lengthy approval processes, these digital platforms can disburse funds within minutes to hours after application.

This article examines the top loan apps in Nigeria that offer 50,000 Naira instantly, their requirements, interest rates, repayment terms, and how to choose the option that best fits your financial needs.

Which Loan App Can Borrow Me 50k For The First Time?

Not all loan apps will give ₦50,000 to a first-time borrower. Most apps start with lower amounts and increase your limit over time. However, some apps may approve ₦50,000 if you meet their requirements.

These apps offer ₦50,000 loans to first-time users:

Carbon:

Carbon offers first-time borrowers loans ranging from 10,000 to 50,000 Naira after app registration and BVN verification. They may also have to perform some profile assessment.

Their interest rates starts at 5% monthly.

Branch:

New users can access loans between 1,000 and 50,000 Naira. Their interest rates vary from 15% to 20% depending on your credit score and loan duration.

FairMoney:

First-time users can borrow between 1,500 and 50,000 Naira with repayment periods of 1-3 months.

Palmcredit:

Offers new users loans from 10,000 up to 50,000 Naira with interest rates between 14% and 24%.

LCredit:

New customers can access between 10,000 and 50,000 Naira with short repayment periods.

Most of these apps increase your loan limit over time as you build a positive repayment history.

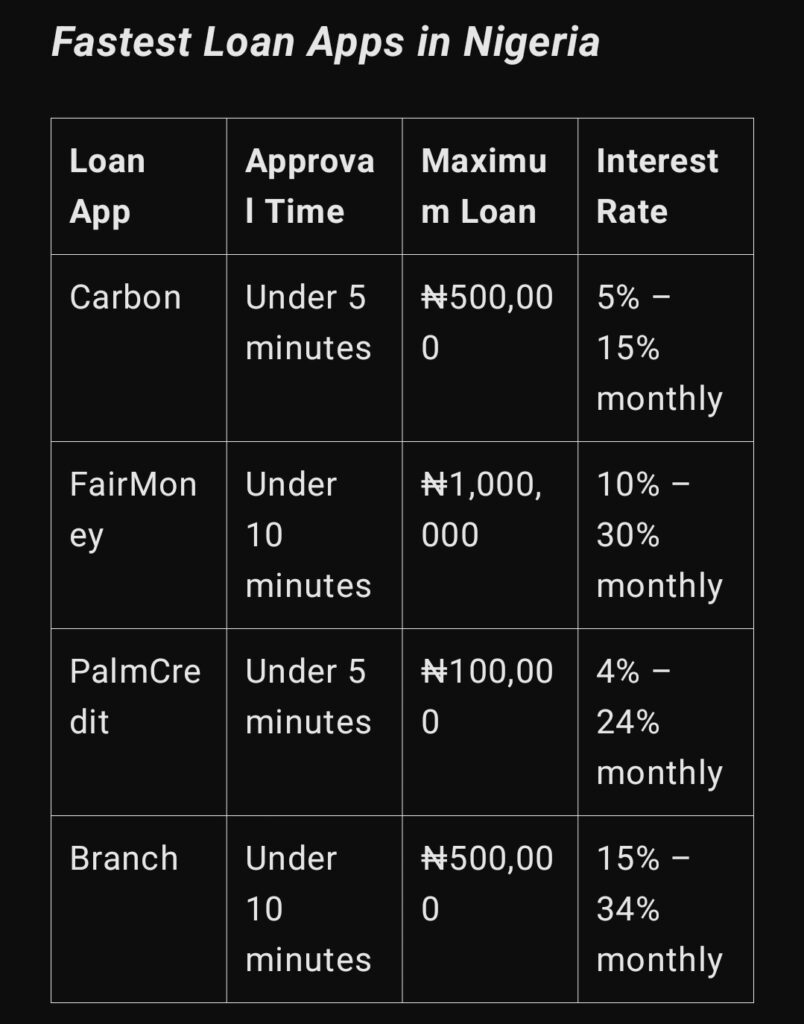

Which App Gives Loans Very Fast?

When you need money urgently, processing time becomes critical. Here are the apps with the fastest loan disbursement in Nigeria:

- Carbon: Loans approved in 5 minutes.

- Opay: Disburses within 10 minutes post-approval.

- Okash: Processes loans in under 15 minutes.

- FairMoney: Usually credits approved loans within 5-30 minutes.

For the fastest experience, complete all verification steps and apply during regular banking hours on weekdays.

Where to Borrow ₦20k in Nigeria?

If you need a smaller loan of 20,000 Naira, these options work well:

- Branch: Offers loans starting from 1,000 Naira with flexible repayment terms. No collateral needed.

- FairMoney: Provides loans from 1,500 Naira with repayment periods of 1-3 months. Higher approval chances for salaried individuals.

- Carbon: Offers loans starting from 10,000 Naira with competitive interest rates.

- QuickCheck: Provides loans from 1,500 Naira with quick disbursement.

- Palmcredit: Offers loans starting from 10,000 Naira with varying interest rates.

- Aella Credit: Provides loans from 5,000 Naira with structured repayment plans.

These apps have simple application processes requiring your BVN, valid ID, and active bank account. Most will run credit checks through the Credit Bureau.

Can Opay Borrow Me Money?

Yes. Opay’s “EaseMoni” service provides loans up to ₦50,000 for first-time users.

Requirements:

- Opay app installed.

- BVN and phone number linked to your bank account.

- An active Opay account

Here’s what you should know:

- Loan amounts range from 10,000 to 500,000 Naira for qualified users

- First-time borrowers typically start with lower amounts (10,000-30,000 Naira)

- Repayment periods range from 91 to 365 days

- Interest rates vary between 0.05% to 1% daily

- Funds are disbursed directly to your Opay wallet

To apply, open your Opay app, navigate to “Finance” and tap on “Apply” under the Loans section, and follow the application steps. Approval depends on your transaction history and credit assessment.

Does Kuda Give A Loan?

Kuda offers loans through their “Overdraft” feature (called “Kuda Overdraft”) up to ₦50,000.

Eligibility:

- Active Kuda account for 3+ months.

- Regular income deposits.

Here are the details:

- It functions as an overdraft rather than a traditional loan

- Available to salary account holders who receive regular income through Kuda

- Amounts depend on your salary and banking behavior

- Interest rate is approximately 0.3% per day

- Repayment happens automatically when funds enter your account

- You must have been using Kuda for at least 3 months with consistent salary deposits

To check your eligibility, open the Kuda app and check the “Borrow” section under “Home.”

How Much Can FairMoney Borrow Me For The First Time?

First-time FairMoney users get ₦1,500–₦50,000.

Here are factors you may also consider:

- Your specific limit depends on the information provided during registration and your credit assessment

- Loan terms range from 1 to 3 months for first-time borrowers

- Interest rates typically range from 10% to 30% monthly depending on your risk profile

- Processing fees apply (usually around 5-10% of the loan amount)

- Requires BVN, government issued ID card, and access to your call logs and contacts

Your loan limit increases as you build a positive repayment history with FairMoney.

Which App Can I Borrow 5000 From?

If you need just ₦5,000, most loan apps will approve it instantly.

- Sokoloan: Instant ₦5,000 without collateral.

- Creditville: ₦5,000–₦50,000 via app or website.

- FlexiLoans: ₦5,000–₦50,000 via palmpay app or flexiLoan website.

- FairMoney: Provides loans starting from 1,500 Naira with 1-3 month repayment terms.

- Branch: Offers micro-loans starting from 1,000 Naira with flexible repayment plans.

These smaller loans often come with shorter repayment periods (7-30 days) and may have higher interest rates relative to the loan amount. They work best for very short-term cash needs.

What Is The Easiest Loan To Get Immediately?

- FairMoney: Minimal paperwork.

- Carbon: No physical documents.

- PalmCredit: Requires only BVN and bank details.

- LCredit: Known for approving loans for users with limited credit history.

- QuickCheck: Has a simple verification process with rapid disbursement.

- Branch:Known for approving loans quickly with minimal documentation. They rely heavily on alternative credit scoring methods.

Factors that make these loans “easy” to get:

- No collateral requirements

- Minimal documentation (just BVN and basic personal information)

- Alternative credit scoring (analyzing phone data rather than traditional credit history)

- Automated approval systems

- No guarantor requirements

However, these conveniences come with higher interest rates compared to traditional bank loans.

What Is The Safest Loan App In Nigeria?

Safety means low fraud risk, transparent fees, and data protection, customer service quality, regulatory compliance

Safest apps (licensed by CBN):

- FairMoney

- Carbon

- Branch

- QuickCheck

- Kuda Overdraft

Always read reviews and check if the app is properly licensed before applying.

How Can I Get A Loan Of 50k?

To successfully secure a 50,000 Naira loan:

- Choose an app (e.g., FairMoney or Carbon).

- Register with your phone number and BVN.

- Applyfor ₦50,000 and submit required details.

- Wait for approval (usually under 30 minutes).

- Repay on time to increase future limits.

Tips to improve your chances:

- Maintain a good credit score if you have existing loans

- Provide accurate and complete information

- Apply during working hours for faster processing

- Ensure your BVN matches your other documentation

- Have sufficient funds for any application fees if required

Conclusion

Multiple apps like FairMoney, Carbon, and Opay can disburse ₦50,000 quickly, even for first-time borrowers.

Compare interest rates, read reviews, and verify CBN licenses to avoid scams. Always borrow responsibly and prioritize repayment to maintain access to future loans.